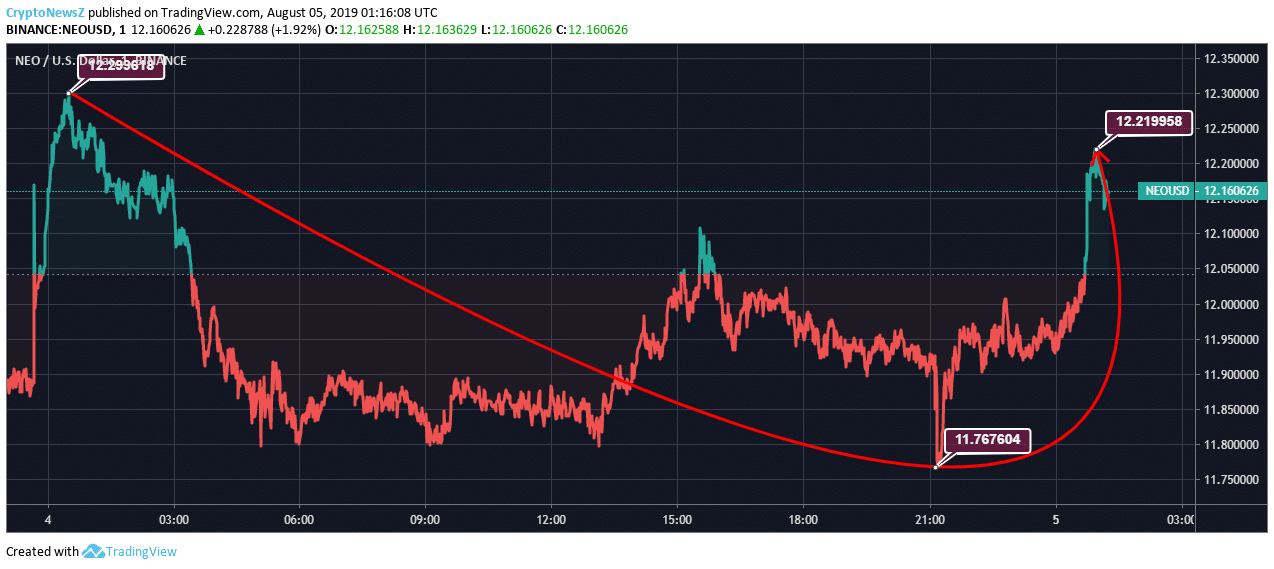

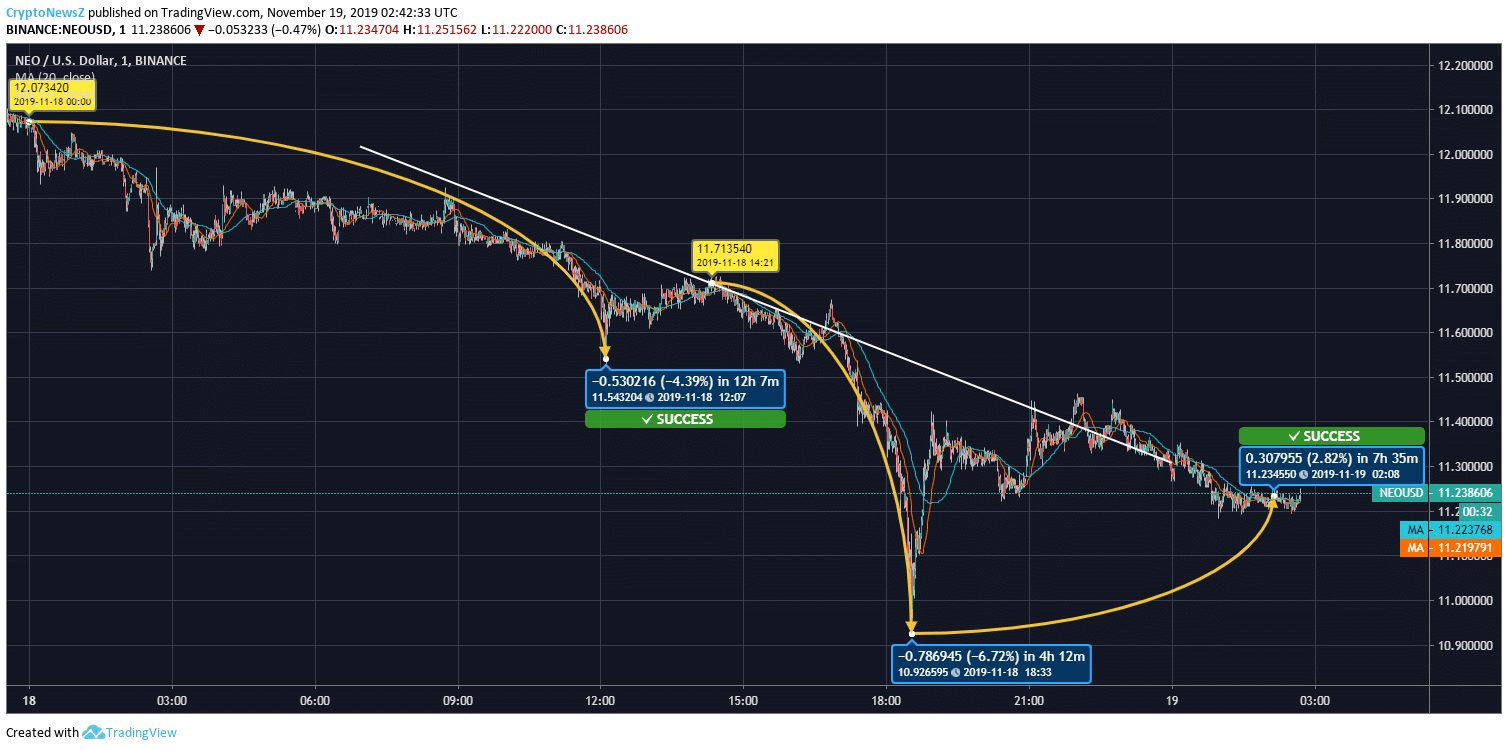

With NEO, as with many other tradable assets, large price swings are often accompanied by spikes in trading volume, as a large number of users buy or sell their coins on exchanges.įundamental analysis (FA), on the other hand, looks at the finances and activities of a company, as well as the state of the wider market and economy. Technical analysis (TA) involves using various indicators while studying price charts in order to make sense of previous price movements. NEO’s price history can be analyzed with many of the same techniques as stock market analysis. A pullback in the second half of that month took prices as low as $72 before a further surge took NEO up to $147 in May. After consolidating in March, the growth became more pronounced in April when NEO reached a peak of $136. There was fresh bullish momentum in the new year as NEO reclaimed $30 in January and $50 in February. The rest of the year saw consolidation and NEO finished 2020 with a value of $14.29. NEO then experienced a period of renewed growth until it reached a high of $26 in September. It soon retraced, however, and bottomed out below $4 after an almost 40% crash on a single day in March. Another attempt to rally in October briefly took prices over $13, but by the end of the year, NEO was worth $8.64.Ģ020 began positively and NEO had almost doubled in price by the middle of February. After three months of decline, these gains had been lost by the end of September, when NEO price dipped back below $7. NEO made some steady gains in the first half of the year, reaching a peak of $24 in June. By 2018’s close, NEO was worth just $7.40, representing a drop of 96% since January’s peak.Ģ019 was less dramatic. Prices dipped as low as $91 the following day and NEO set a series of lower highs and lower lows for the rest of the year. At that point, Neo had a market cap of $12 billion. The surge continued into 2018 when it culminated in a peak at NEO’s all-time high of $206.67 on 15 January. December brought fresh bullish momentum and by the end of the year, NEO had climbed to over $75 – an increase of more than 54,000% since the start of the year.

During the first fortnight of August, NEO’s market cap surpassed $1 billion for the first time as its price surged by 690% to a peak of $58, before falling back to $13 a month later. The next month was spent in consolidation, with prices dipping as low as $5 before the rally resumed in the second half of July. The growth became much steeper in June when NEO reached a peak above $11. The end of April saw the start of a rally which took prices above $1 for the first time in May. NEO failed to make any significant gains for the first two months of 2017 but was back above $0.20 by the end of March. The rest of that year was spent mostly under $0.20, with a dip below $0.10 in October. Neo was sold at $0.20 per token in its initial coin offering (ICO) which ended in September 2016.

We’ve compiled everything you need to understand NEO price – as well as the factors which influence it. Since the cryptocurrency launched in 2016, its price has seen significant change and if you want to know why then you’re in the right place. NEO, on the other hand, is used for governance, and NEO holders are the owners of the network. The network employs a unique dual token system, in which GAS is used to pay for network fees, smart contract deployments, and in-Dapp purchases. Initially called Antshares, Neo provides blockchain infrastructure for the building of decentralized apps (Dapps), with interoperability, built-in oracles, and one block finality. Sometimes described as China’s answer to Ethereum, Neo was founded in 2014 by Da Hongfei and Erik Zhang. And the lowest recorded NEO price is EUR. The market rank of Neo is based on a market capitalization of EUR.

The price has changed by EUR in the past 24 hours on trading volume of EUR.

0 kommentar(er)

0 kommentar(er)